Not known Incorrect Statements About Ach Payment Solution

Cable transfers are likewise much more costly than ACH repayments. While some banks don't bill for wires, in some instances, they can set you back customers approximately $60. EFT settlements (EFT means electronic funds transfer) can be made use of mutually with ACH payments. They both explain the exact same repayments mechanism.:-: Pros Expense: ACH settlements tend to be less expensive than wire transfers Speed: faster considering that they do not use a "set" procedure Cons Speed: ACH payments can take a number of days to refine Price: fairly pricey source: There are 2 sorts of ACH repayments.

ACH credit history deals allow you "push" money to various financial institutions (either your very own or to others). They make use of ACH credit transactions to press cash to their staff members' bank accounts at assigned pay durations.

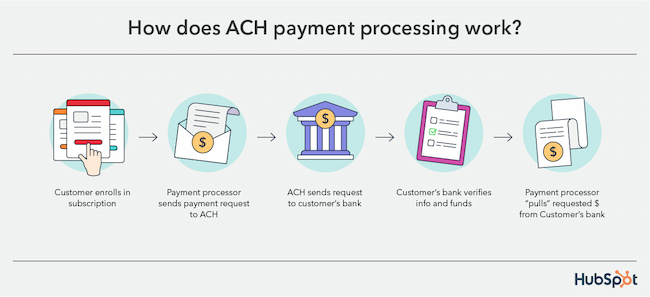

Consumers that pay a business (claim, their insurance coverage carrier or mortgage lending institution) at specific periods might pick to register for recurring payments. That provides the company the ability to launch ACH debit purchases at each invoicing cycle, pulling the quantity owed directly from the client's account. Other than the Automated Cleaning Residence network (which attaches all the banks in the United States), there are 3 other players included in ACH settlements: The Originating Depository Financial Institution (ODFI) is the financial institution that initiates the purchase.

An Unbiased View of Ach Payment Solution

The National Automated Clearing Residence Organization (NACHA) is the detached governmental entity responsible for supervising as well as regulating the ACH network (ach payment solution). Let's take your automated month-to-month phone costs repayments as an example. When you enroll in autopay with your phone firm, you supply your checking account details (routing as well as account number) and also authorize a recurring payment permission.

The 2 financial institutions after that communicate to make sure that there suffice funds in your bank account to refine the purchase. If you have adequate funds, the transaction is processed and also the cash is transmitted Read More Here to your communications provider's savings account. ACH payments normally take numerous business days (the days on which financial institutions are open) to go with.

Per the guidelines set forth by NACHA, banks can pick to have actually ACH credit scores refined as well as supplied either within a business day or in one to two days. ACH debit deals, on the various other hand, should be refined by the following company day. After receiving the transfer, the other financial institution could also apprehend the transferred funds for a holding period.

The modifications (which are taking place in phases) will make feasible widespread usage of same-day ACH settlements by March 2018. ACH payments are commonly extra budget-friendly for organizations to process than credit cards.

The Single Strategy To Use For Ach Payment Solution

Some ACH cpus bill a flat rate, which commonly ranges from $0. 5 percent to one percent per purchase. Companies might also charge an added month-to-month cost for ACH repayments, which can vary.

These decline codes are essential for supplying the appropriate information to your customers regarding why their settlement didn't undergo (ach payment solution). Below are the 4 most common reject codes: This indicates the customer didn't have sufficient cash in their account to cover the amount of the debit entry. When you get this code, you're most likely going to have to rerun the deal after the customer transfers even more money right into their account or supplies a various settlement technique.

It's likely they neglected to notify you of the adjustment. They have to offer you with a new bank account to refine the deal. This code is set off when some combination of the data provided why not try these out (the account number as well as name on the account) doesn't match the bank's records or a missing account number was gotten in.

If a financial institution does not allow a service to take out funds from a certain savings account, you'll get this reject code. In see this here this instance, the client needs to supply their bank with your ACH Producer ID to allow ACH withdrawals by your service. After that you require to rerun the purchase. However, declined ACH settlements can land your business a penalty cost.

The 10-Second Trick For Ach Payment Solution

To avoid the hassle of disentangling ACH turns down, it may deserve only approving ACH repayments from relied on clients. The ACH network is handled by the federal government as well as NACHA, ACH payments don't have to comply with the same PCI-compliance standards required for charge card handling. NACHA calls for that all parties associated with ACH purchases (including companies initiating the repayments and third-party cpus) execute procedures, procedures, as well as controls to safeguard sensitive data.

That suggests you can not send out or receive financial institution details using unencrypted e-mail or unconfident internet kinds. Make sure that if you use a 3rd party for ACH settlement processing, it has applied systems with modern encryption methods. Under the NACHA guidelines, begetters of ACH settlements should likewise take "readily sensible" actions to make sure the legitimacy of customer identification and also transmitting numbers, and to recognize possible fraudulent task.

Comments on “Ach Payment Solution Can Be Fun For Anyone”